Hello Everyone, I am new here. I would like to ask where there is a description of the parameters of the indicators built into the system? I am on trail of the latest version wealth-lab and want to reproduce a strategy I have implemented in other software for testing.

However, there is a very simple strategy that I have built through my attempts using building blocks, but nothing about it gives me the results I want. I suspect that I am misunderstanding the parameters of the indicator and would like to inquire if there is appropriate information I can check.

As well as the functionality of the indicator symbol inside the qualifiers, I would like to ask if placing it in the block means setting my trade target and the underlying of the indicator separately , in order to realize the intermarket trading?

However, there is a very simple strategy that I have built through my attempts using building blocks, but nothing about it gives me the results I want. I suspect that I am misunderstanding the parameters of the indicator and would like to inquire if there is appropriate information I can check.

As well as the functionality of the indicator symbol inside the qualifiers, I would like to ask if placing it in the block means setting my trade target and the underlying of the indicator separately , in order to realize the intermarket trading?

Rename

Welcome to the forum John. If you share the trading system's rules (to comprehend the idea), what exact Blocks are laid on the Design Surface (to verify the implementation) and optionally your Strategy Settings (to understand what market it's appled to), we should be able to make a suggestion.

Hi Eugene,

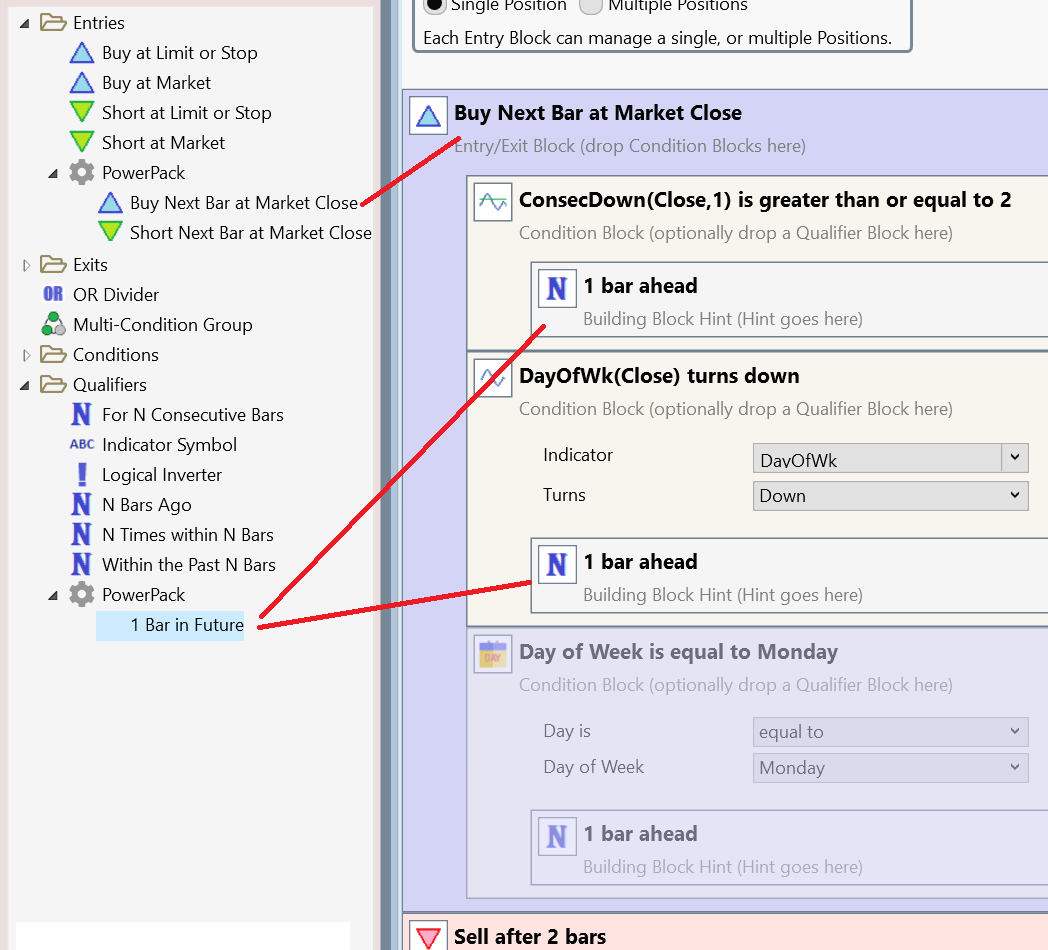

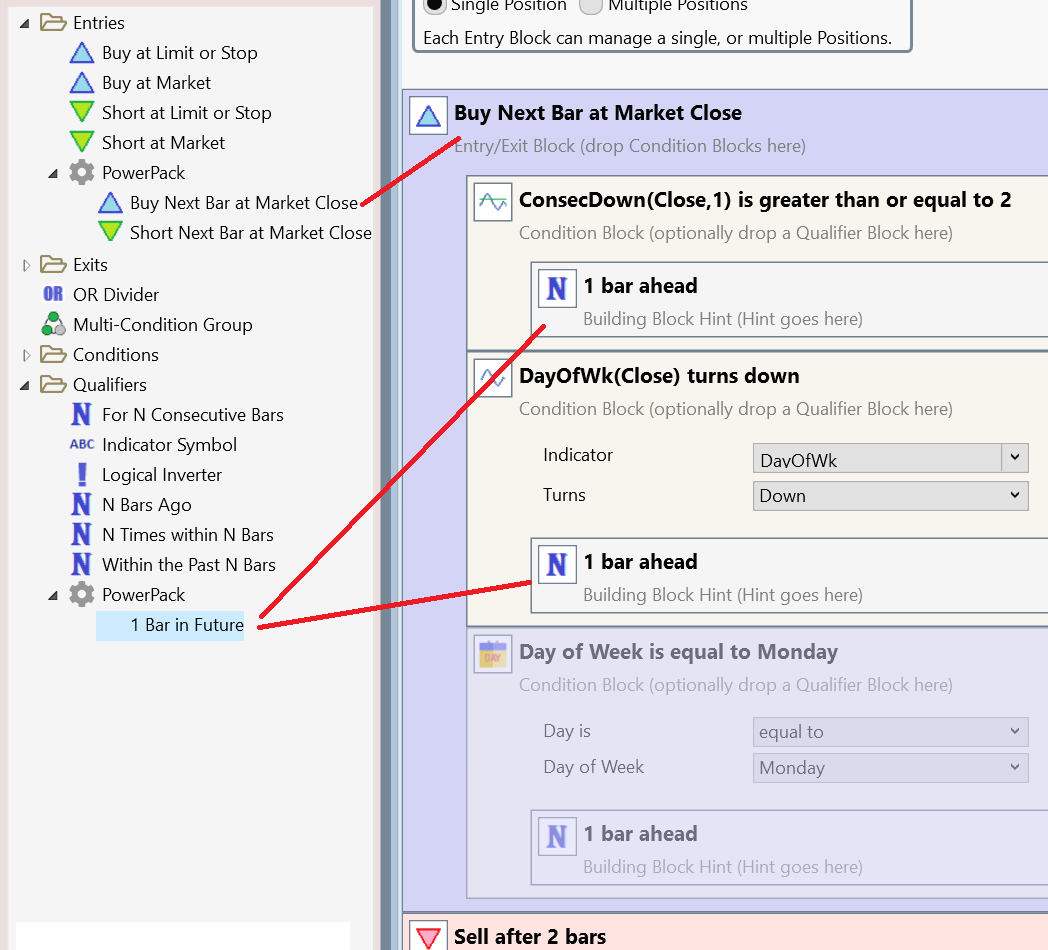

Thanks for your help.For example, I have two cases where I'm not sure if it's correct to set it up like in the screenshot.

Case one:

Today is Monday.

tsla were consecutively down today and the previous trading day (if last Friday was a holiday, the previous trading day was last Thursday)

Buy at today's(monday) closing price if conditions are met

Case two:

Today's closing price is greater than the previous day's high

Thanks for your help.For example, I have two cases where I'm not sure if it's correct to set it up like in the screenshot.

Case one:

Today is Monday.

tsla were consecutively down today and the previous trading day (if last Friday was a holiday, the previous trading day was last Thursday)

Buy at today's(monday) closing price if conditions are met

Case two:

Today's closing price is greater than the previous day's high

QUOTE:This is specific enough to answer, but just know that you can hit "F1" while using any tool to get some help. Follow the links - each block has an explanation.

As well as the functionality of the indicator symbol inside the qualifiers, I would like to ask if placing it in the block means setting my trade target and the underlying of the indicator separately , in order to realize the intermarket trading?

Example for Indicator Symbol :

This block will Buy At Market (for any symbol under test) when that symbol's Close crosses over its 20-period SMA, but only if SPY's 14-period RSI is below 30. The symbol(s) to be backtested are specified in the Strategy Settings - either single symbol or a Portfolio using a DataSet.

See my example. If you're testing TSLA, then it's not required to use the qualifier.

Indicators are applied to the symbol being tested unless you use that qualifier.

Case 1 - correct, but it would be better to use "greater than or equal to" in case there are more than 2 bars down in a row.

Case 2 - correct again

Indicators are applied to the symbol being tested unless you use that qualifier.

Case 1 - correct, but it would be better to use "greater than or equal to" in case there are more than 2 bars down in a row.

Case 2 - correct again

Hi Cone,

Thanks for your explanation. If I understand the indicator correctly, I tried again still having some problems with the example I want to set up:

Test Target: QQQ

Today is Monday

Today and the previous trading day are continuously down

Buy at today’s close price when conditions are met

Use all positions

Sell at today‘s close price when today's closing price is greater than the previous day's high

Backtest time: 2020.1.1 - 2023.12.31

screenshots of my setup:

backtest results I got:

It's obviously not right that the system is showing only 2 trades, I've just checked with other systems and it should be 240. but I can't really find what's wrong with my setup.

Does this have anything to do with the system I am using,? I am using a virtual machine on mac os to run the software.

Thanks for your explanation. If I understand the indicator correctly, I tried again still having some problems with the example I want to set up:

Test Target: QQQ

Today is Monday

Today and the previous trading day are continuously down

Buy at today’s close price when conditions are met

Use all positions

Sell at today‘s close price when today's closing price is greater than the previous day's high

Backtest time: 2020.1.1 - 2023.12.31

screenshots of my setup:

backtest results I got:

It's obviously not right that the system is showing only 2 trades, I've just checked with other systems and it should be 240. but I can't really find what's wrong with my setup.

Does this have anything to do with the system I am using,? I am using a virtual machine on mac os to run the software.

You’re using a 50k account size and a 50k position size. As soon as you get a losing trade your equity will dip below 50k so all future trades will have non-sufficient funds (NSF).

You can instead use 100% of Equity sizing and give a little margin like 1.1 to 1 to cover cases where prices gap up overnight.

You can instead use 100% of Equity sizing and give a little margin like 1.1 to 1 to cover cases where prices gap up overnight.

Sorry - I just noticed you wrote, "Buy at today's(monday) closing price if conditions are met".

Buying at Close requires 2 things (available in the PowerPack):

1. a Buy at Market Close block, and,

2. a Signal from the bar/day before the bar/day of the Close you want to trade.

In other words, you can't evaluate/trade the "Closing Price" on Monday and buy at the close. It's not possible without peeking ahead, which you can do (see below) with the understanding that it's not possible for the strategy to give you signals..

Below I used DayofWeek Turns down to indicate the transition to the new week. This will account for Friday and Monday holidays. But if you really want it to be Monday, use the Monday rule.

Buying at Close requires 2 things (available in the PowerPack):

1. a Buy at Market Close block, and,

2. a Signal from the bar/day before the bar/day of the Close you want to trade.

In other words, you can't evaluate/trade the "Closing Price" on Monday and buy at the close. It's not possible without peeking ahead, which you can do (see below) with the understanding that it's not possible for the strategy to give you signals..

Below I used DayofWeek Turns down to indicate the transition to the new week. This will account for Friday and Monday holidays. But if you really want it to be Monday, use the Monday rule.

Thanks Cone, I see where I went wrong. After I change the position and margin setup, it give me the right results.

And I also realize the problem about"closing price", I noticed that the system automatically used the next day's opening price.

And I also realize the problem about"closing price", I noticed that the system automatically used the next day's opening price.

Re: .used the next day's opening price.

Right, there's a major difference between "At Market" and "At Close" orders. These signals operate like their brokerage counterparts in a backtest and will trigger (when not peeking) the correct order type for a real trade at the broker.

Right, there's a major difference between "At Market" and "At Close" orders. These signals operate like their brokerage counterparts in a backtest and will trigger (when not peeking) the correct order type for a real trade at the broker.

Your Response

Post

Edit Post

Login is required