I ran the strategy - "Dynamic Breakout System" in the Sample Strategies folder and the profit/loss calculations seem off. I try to factor in the trading commission but the number still not comes out correctly. I am not sure if there any others costs/fees/factors that might affect the profit/loss calculations.

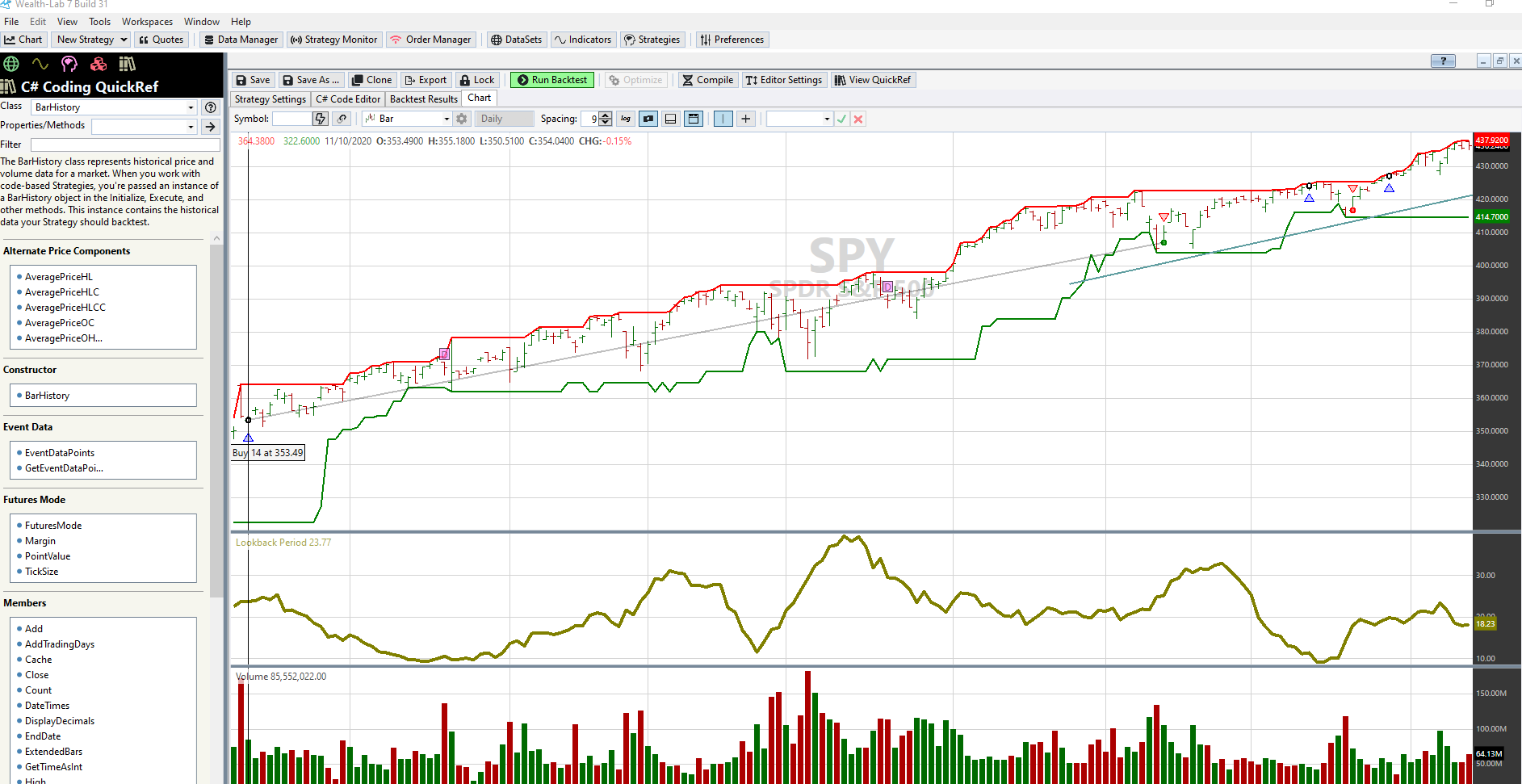

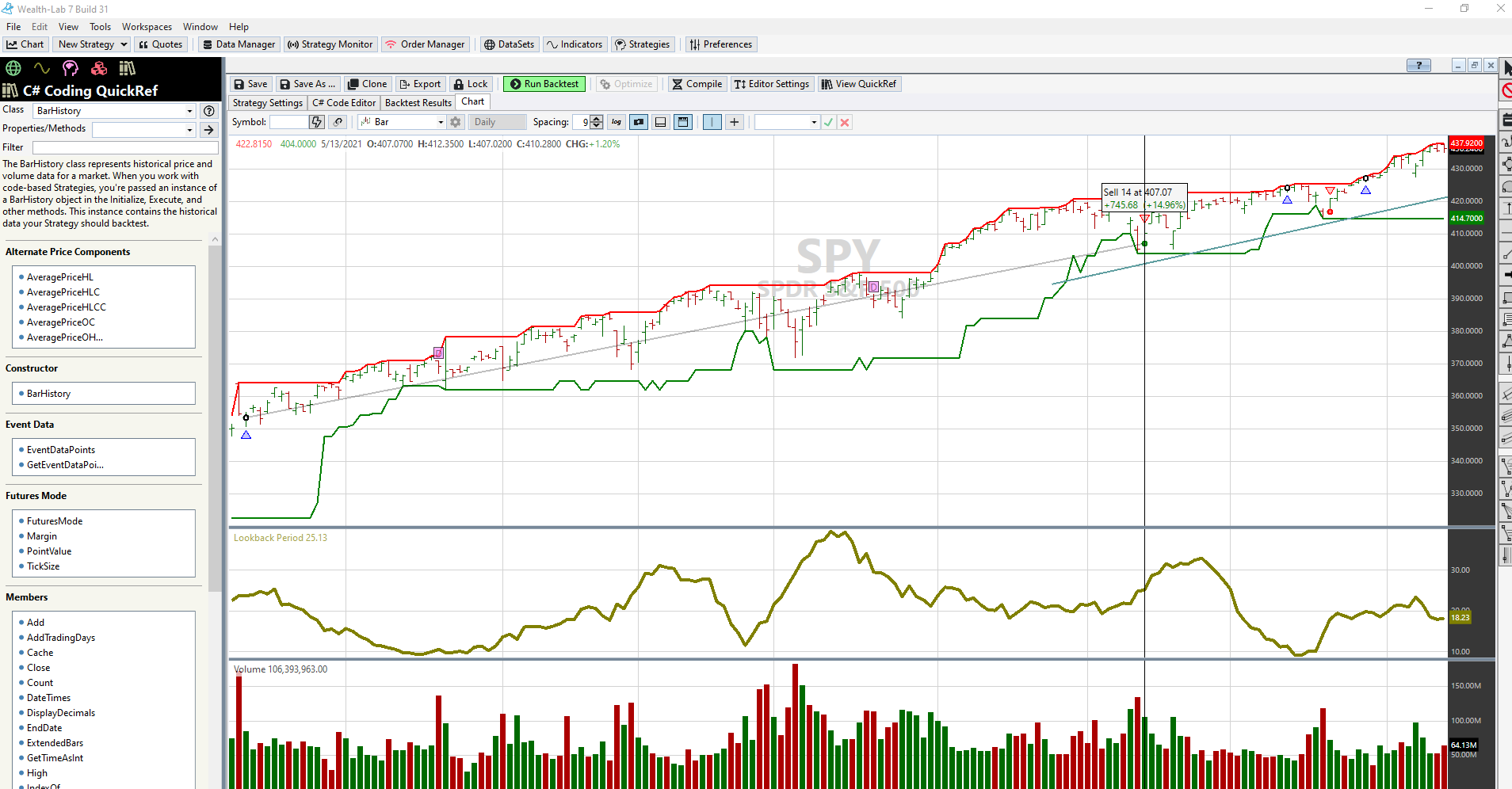

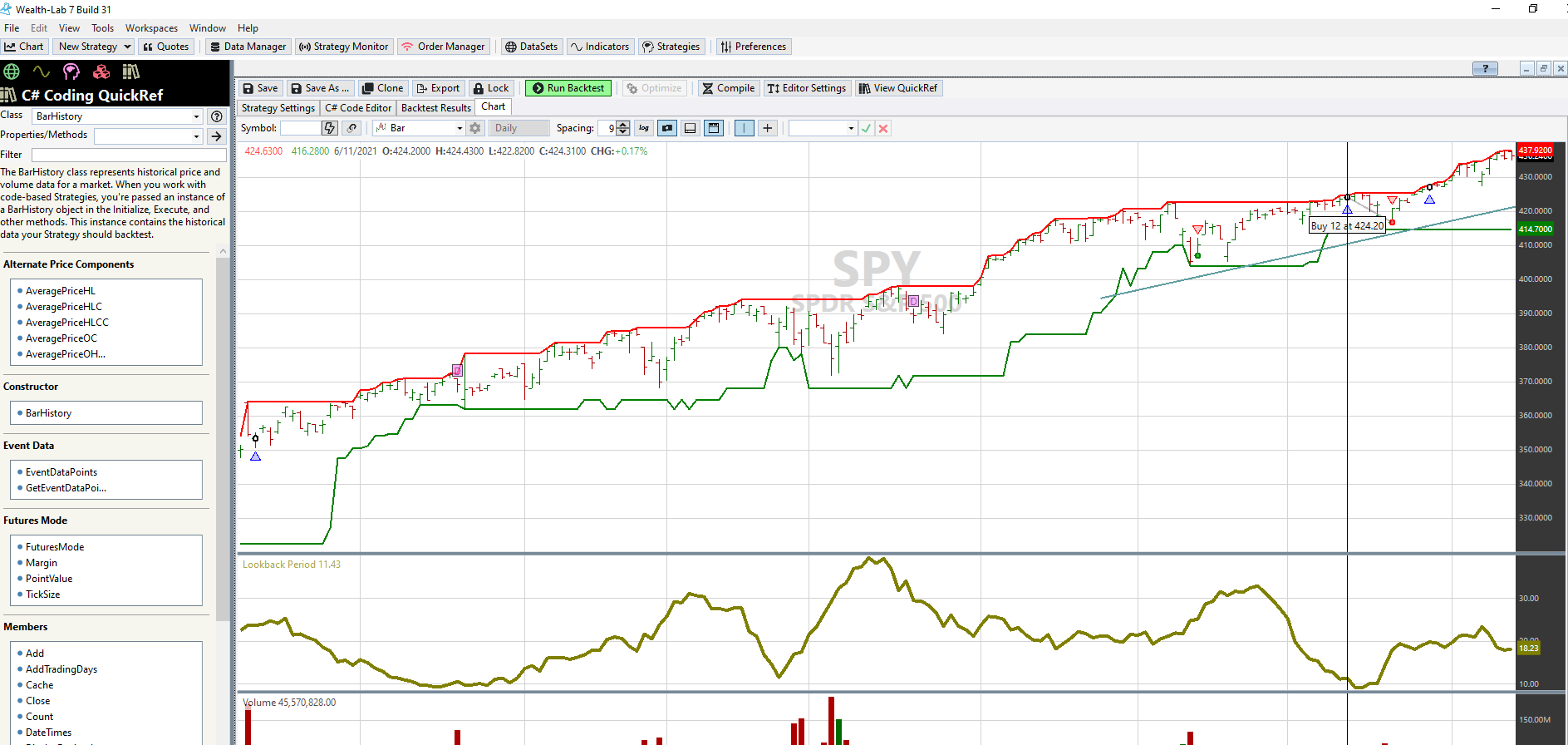

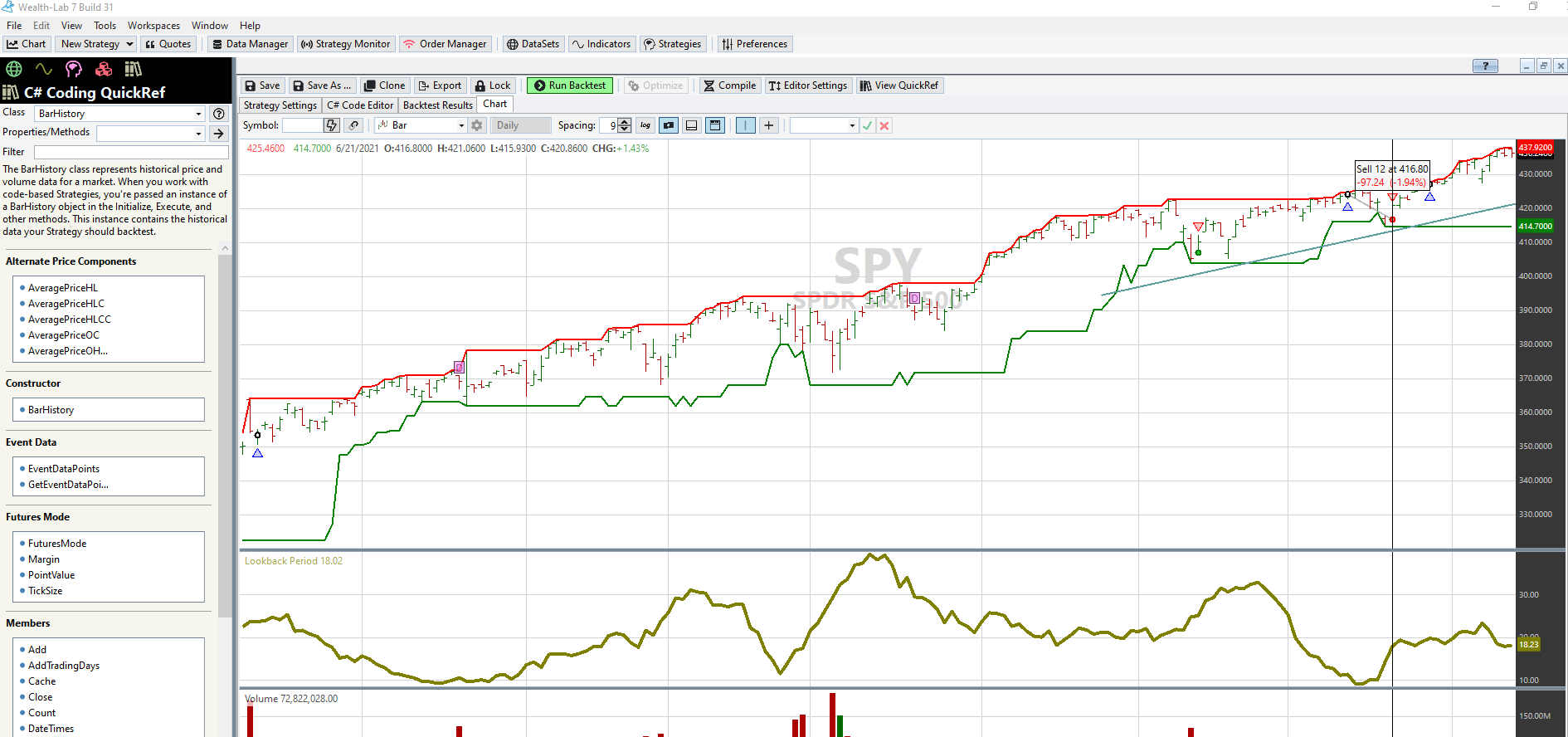

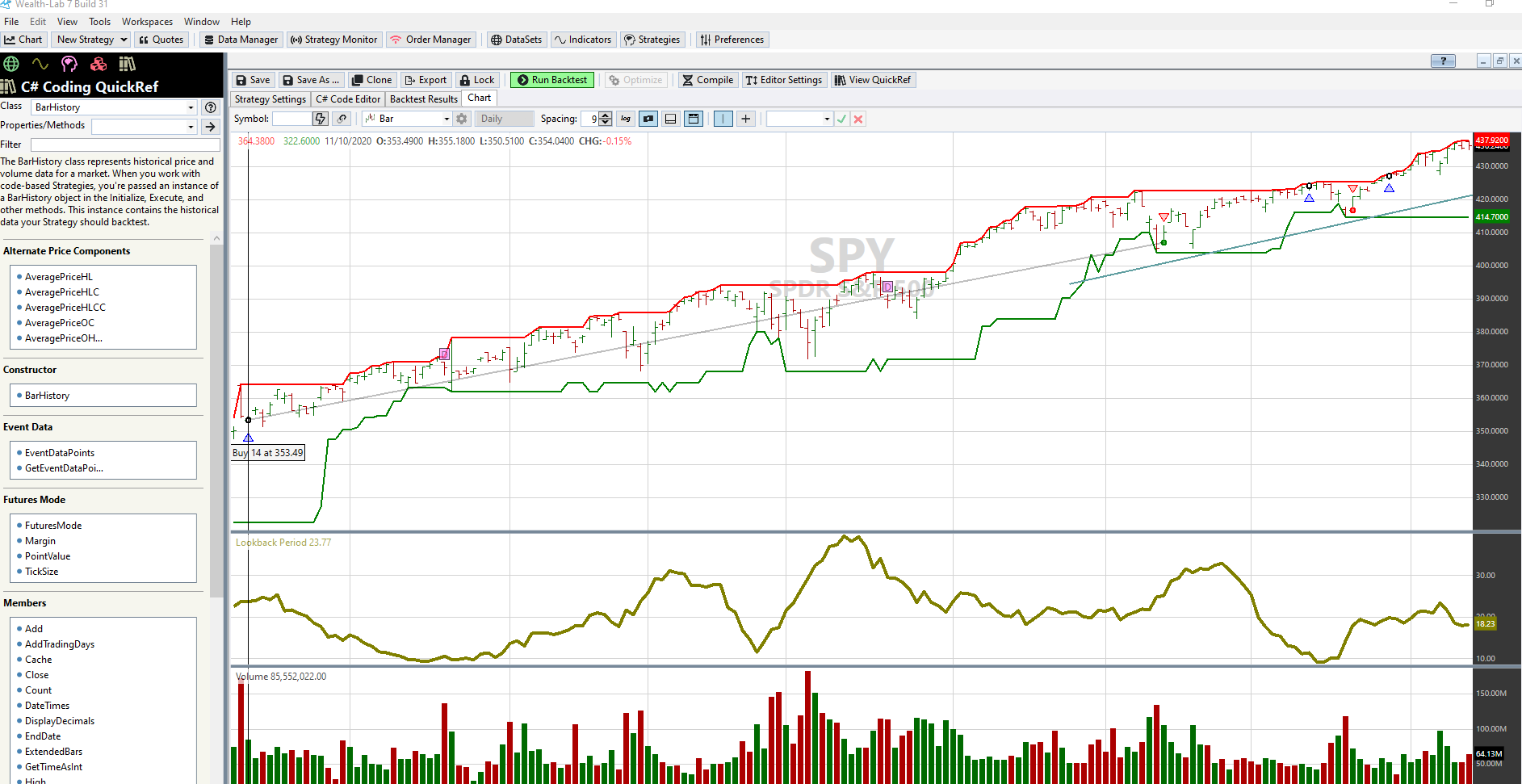

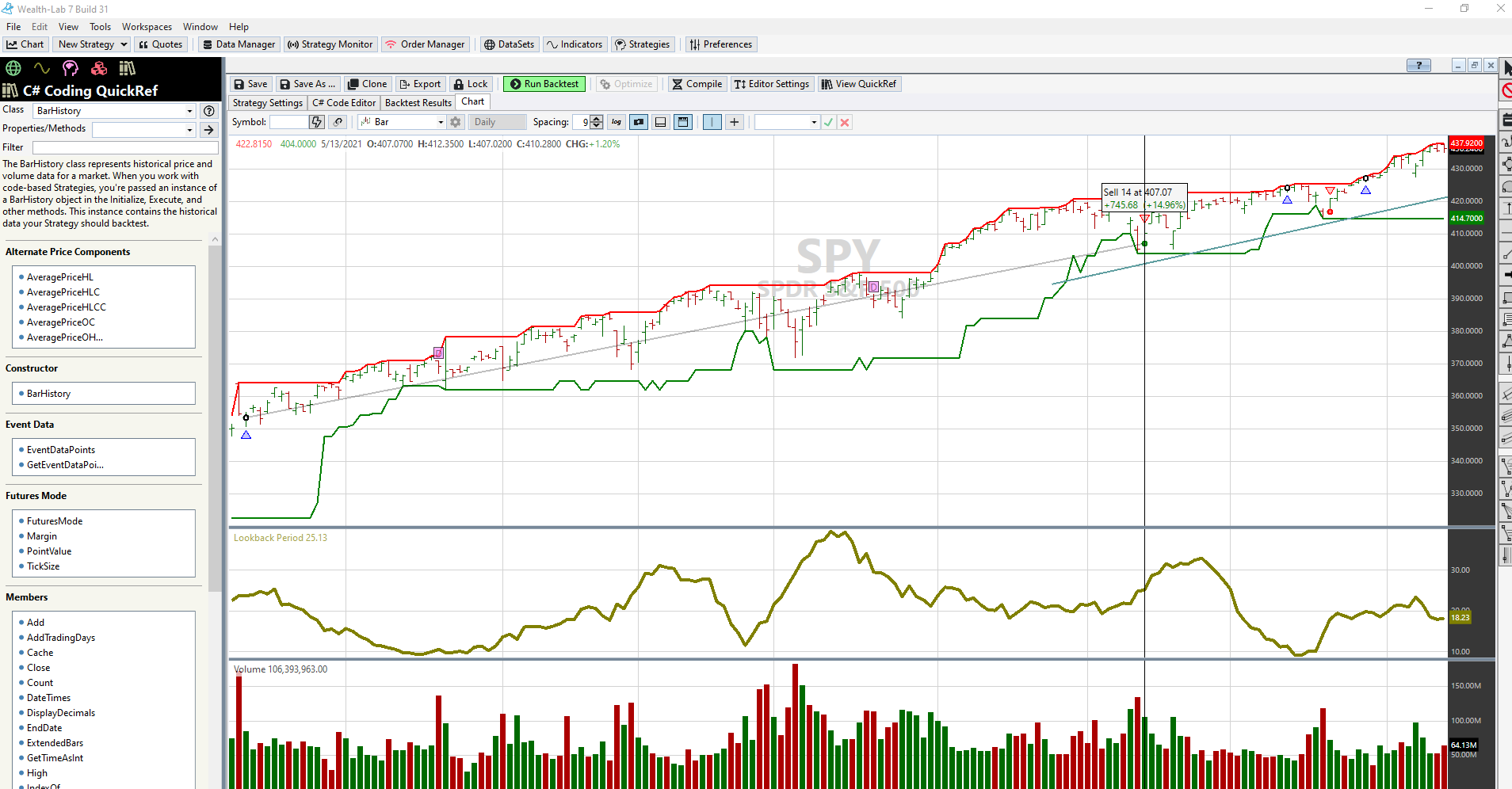

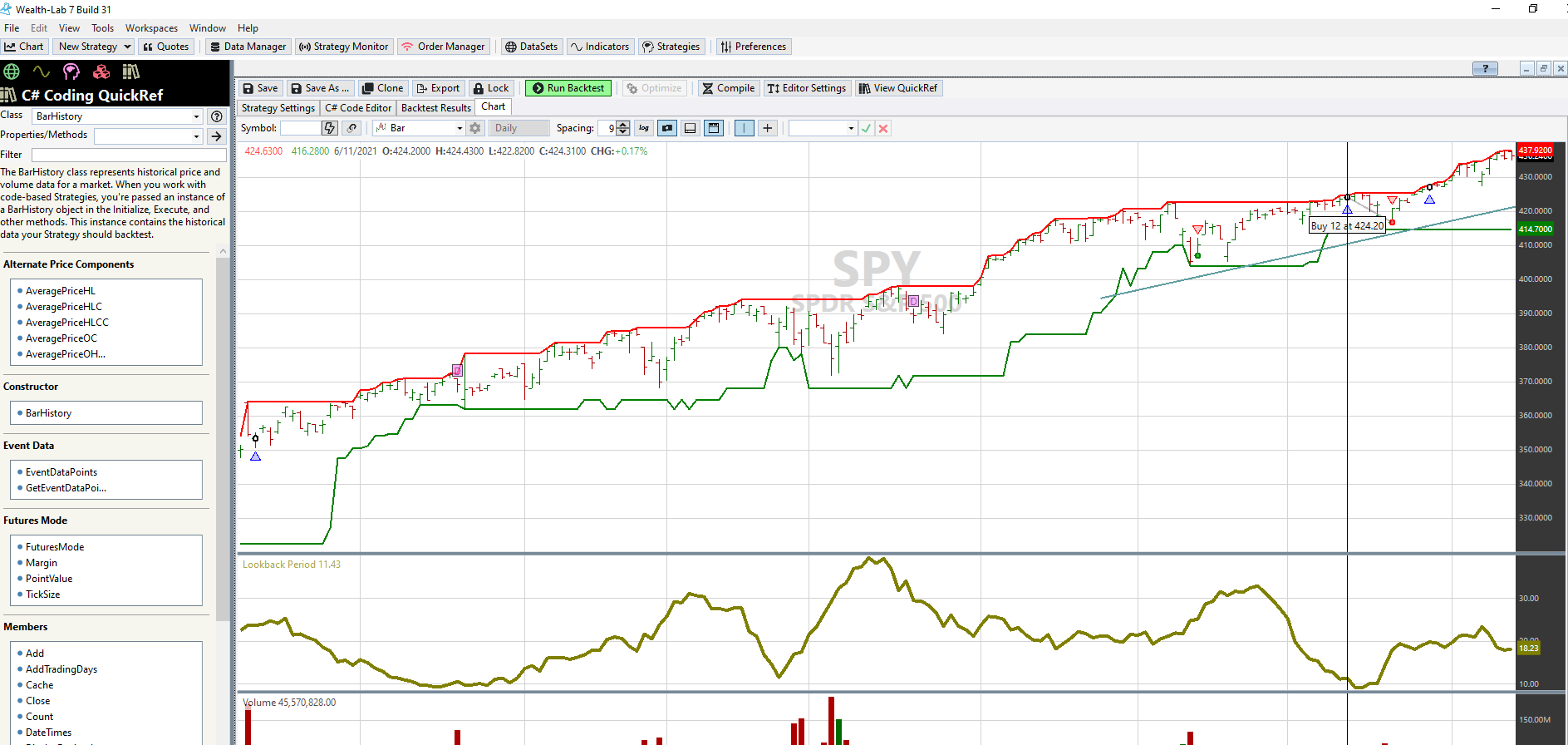

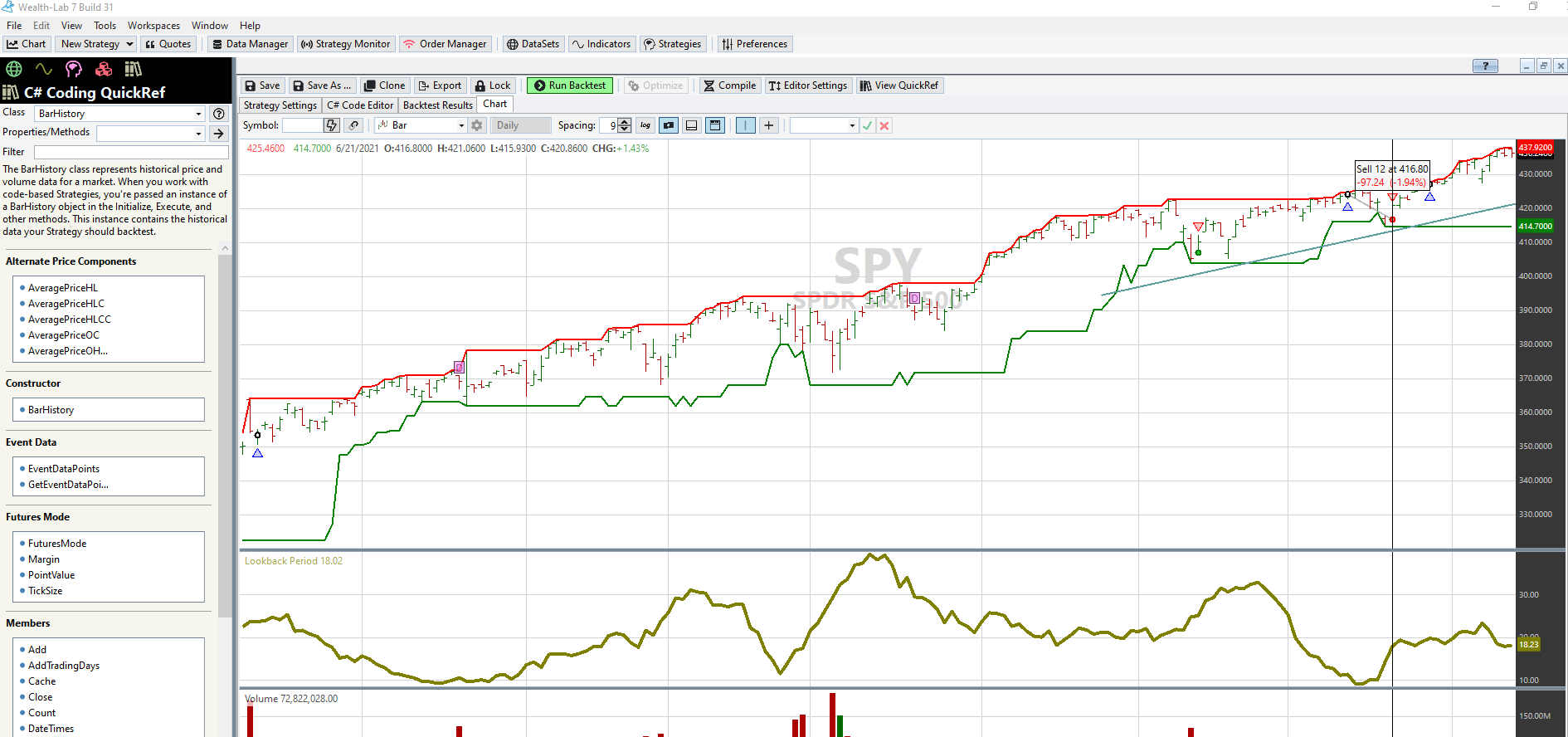

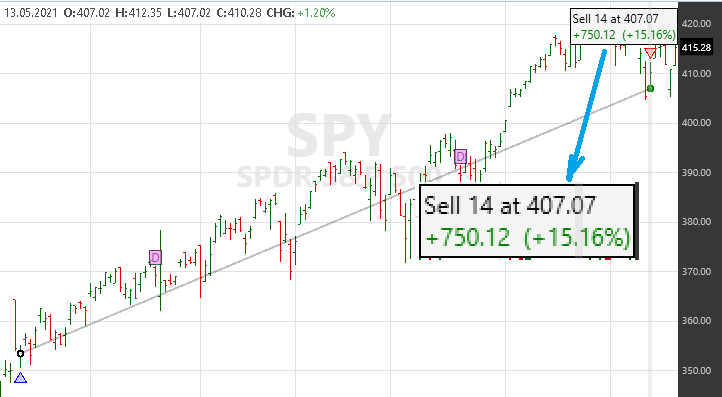

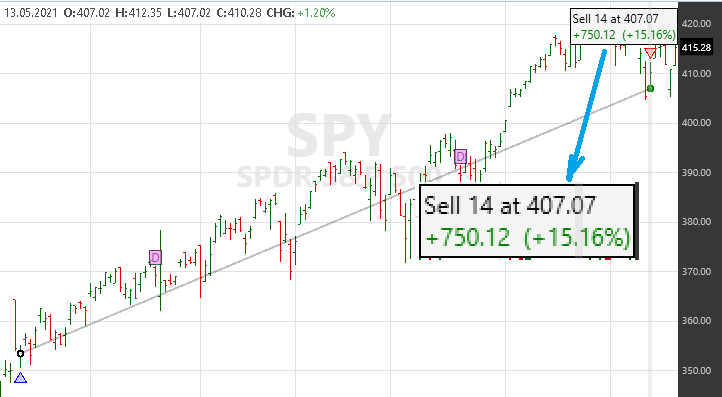

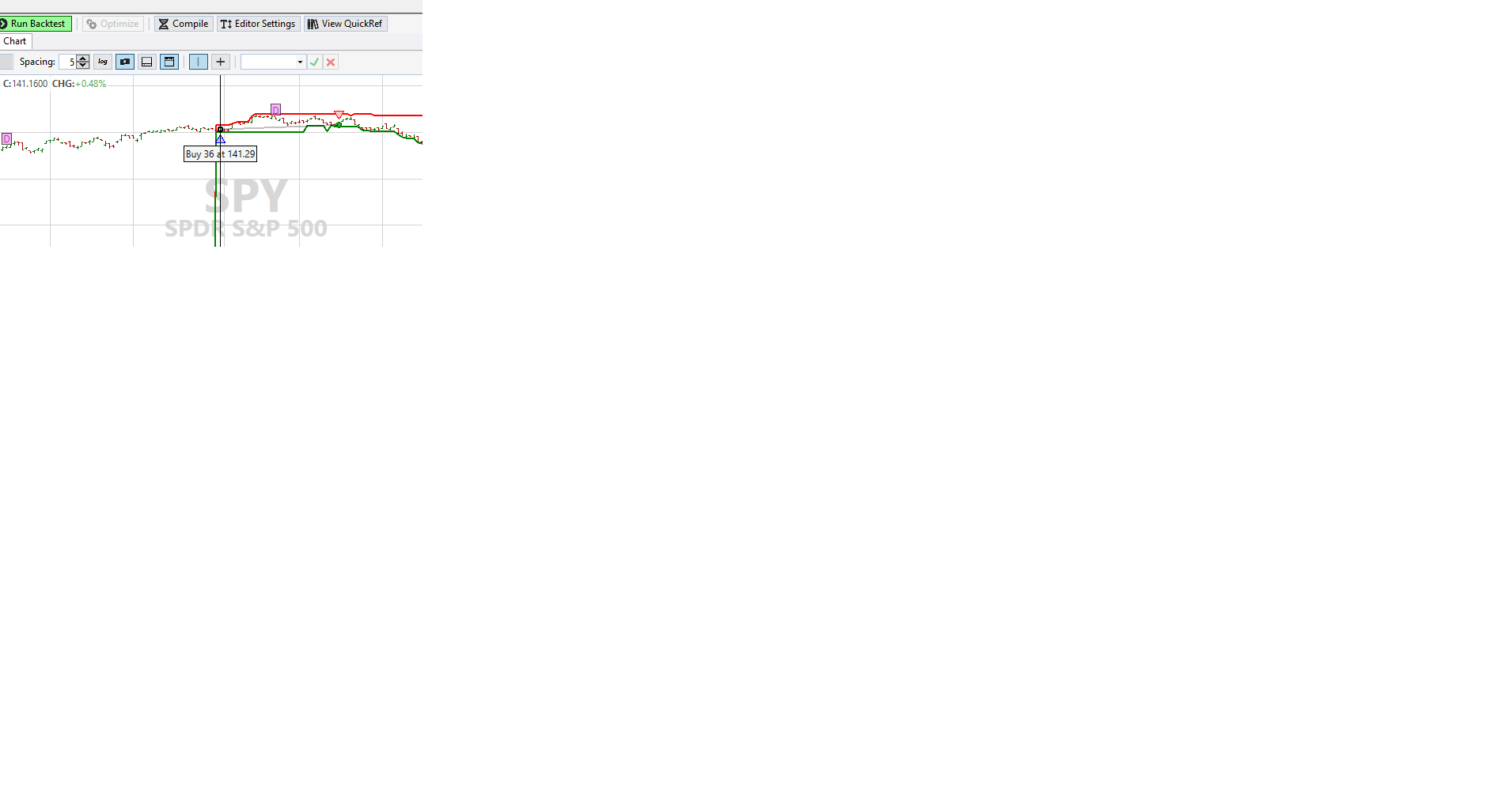

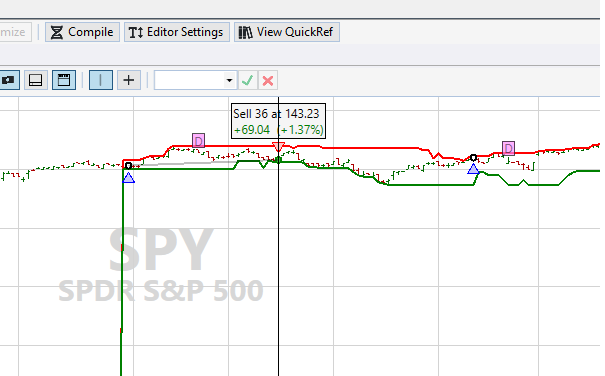

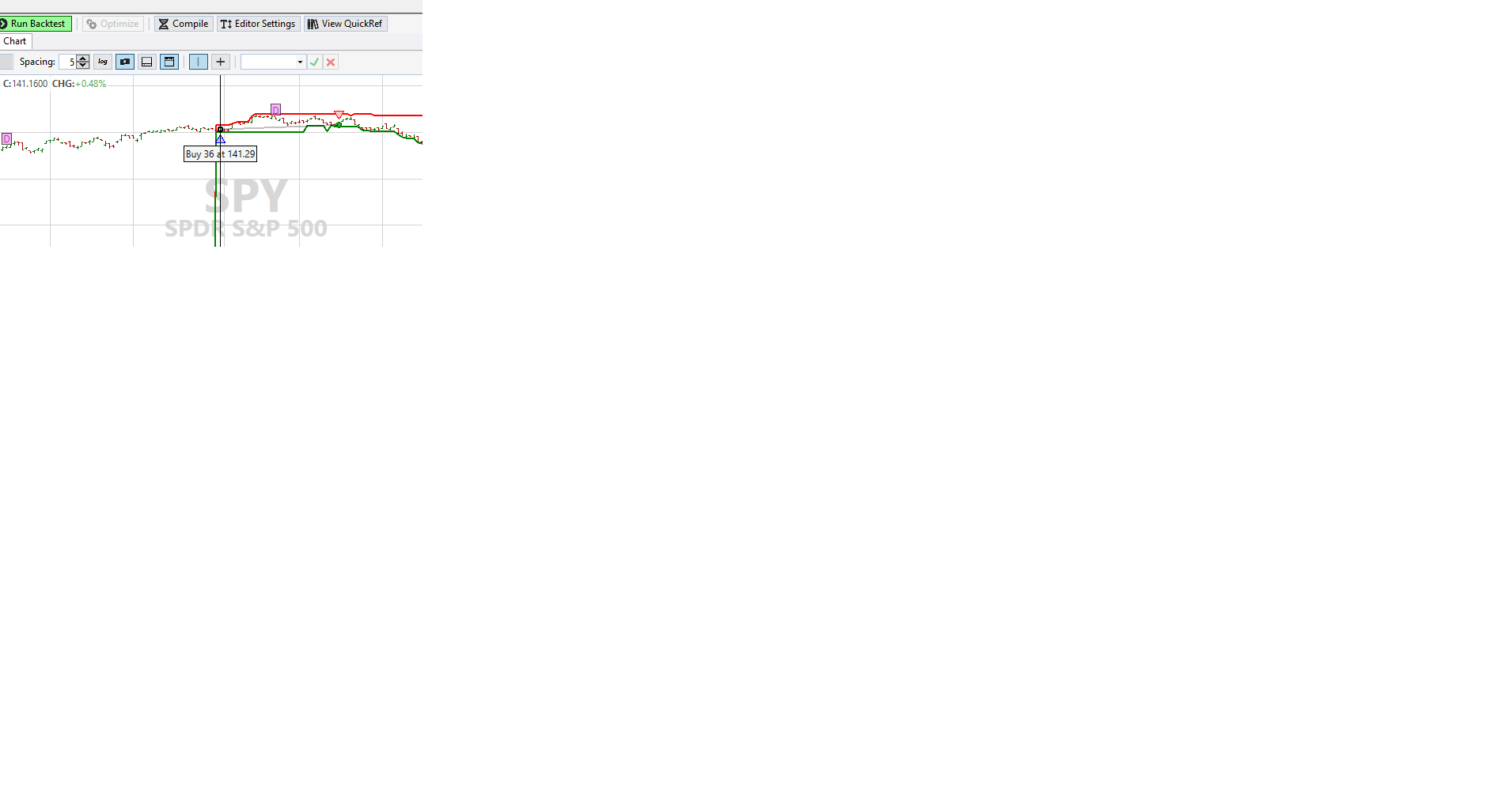

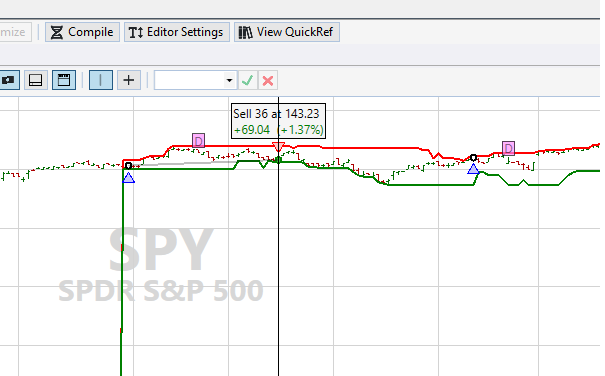

The sample calculations done here are for two trades, the first 2 pictures below are showing entry and exit prices for trade 1 and the last two pics are showing entry and exit prices for trade 2. The profit loss displayed on the chart as seen in the picture not matched with the math.

Strategy settings:

Symbol: SPY

Data Scale: Daily

Data Range: most recent 10 yrs

Position size: $5000

trade 1:

pnl = # of shares * (exit price - entry price)

pnl = 14 * ($407.07 - $353.49)

pnl = $750.12

The pnl on the chart shows a value of +$745.68 instead.

trade 2:

pnl = 12 * ($416.8 - $424.2)

pnl = -$88.8

The pnl on the chart shows a value of -$97.24

#BugReport

The sample calculations done here are for two trades, the first 2 pictures below are showing entry and exit prices for trade 1 and the last two pics are showing entry and exit prices for trade 2. The profit loss displayed on the chart as seen in the picture not matched with the math.

Strategy settings:

Symbol: SPY

Data Scale: Daily

Data Range: most recent 10 yrs

Position size: $5000

trade 1:

pnl = # of shares * (exit price - entry price)

pnl = 14 * ($407.07 - $353.49)

pnl = $750.12

The pnl on the chart shows a value of +$745.68 instead.

trade 2:

pnl = 12 * ($416.8 - $424.2)

pnl = -$88.8

The pnl on the chart shows a value of -$97.24

#BugReport

Rename

Hi Tom,

The short answer: display rounding to 2 decimals

The long answer:

https://www.wealth-lab.com/Discussion/Profit-Calculation-Off-Why-5881

The short answer: display rounding to 2 decimals

The long answer:

https://www.wealth-lab.com/Discussion/Profit-Calculation-Off-Why-5881

Hi Glitch,

I am not sure if this is due to 2 decimals rounding-off error. On the two trades, the errors are shown below:

error (trade 1) = |$745.68 - $750.12| = $4.44

error (trade 2) = |-$97.24 - (-$88.8)| = $8.44

As you can see, the error magnitudes this large could not be explained with rounding-off errors.

I am not sure if this is due to 2 decimals rounding-off error. On the two trades, the errors are shown below:

error (trade 1) = |$745.68 - $750.12| = $4.44

error (trade 2) = |-$97.24 - (-$88.8)| = $8.44

As you can see, the error magnitudes this large could not be explained with rounding-off errors.

Glitch,

I want to add that the two trades that I selected and showed their calculations on the previous post are picked randomly from the simulation run. I do a quick check on other trades and the error magnitudes are similar to the two shown here.

Could you run a simulation with the strategy and its settings on Post #1 like I did and see whether your results are same/different as/from mine. It is possible that there are settings that I was not aware of.

For the this simulation, I have turned off slippage and the trading commission is set to $4.95/trade by default. (When I set the trading commission to $0, the error magnitudes remain similar to earlier cases). Thanks.

I want to add that the two trades that I selected and showed their calculations on the previous post are picked randomly from the simulation run. I do a quick check on other trades and the error magnitudes are similar to the two shown here.

Could you run a simulation with the strategy and its settings on Post #1 like I did and see whether your results are same/different as/from mine. It is possible that there are settings that I was not aware of.

For the this simulation, I have turned off slippage and the trading commission is set to $4.95/trade by default. (When I set the trading commission to $0, the error magnitudes remain similar to earlier cases). Thanks.

This must be the effect of commissions. It's working for me as expected, returning the expected value on that 1st trade (Wealth-Data, $5000 size, Commission/Slippage/Other ALL disabled)

14 * $407.07 - $353.49 = $750.12

14 * $407.07 - $353.49 = $750.12

The answer is in the data, so let's start with the Data Provider. Which one is it?

Judging by the prices (not matching Yahoo's) and the symbol description, topic starter must be using Wealth-Data (like I did).

QUOTE:In that case, where did 407.07 and 353.49 come from in this calculation? They should be 407.02 and 353.52.

14 * $407.07 - $353.49 = $750.12

Just to be on the safe side, I'd recommend topic starter to "Delete local files" and reload cached data.

Please just add this to your strategy, post the debug log and we'll know everything we need to know!

CODE:

public override void BacktestComplete() { foreach(Position p in Backtester.Positions) { WriteToDebugLog(string.Format("{8}\t{9}\t{0:d}\t{1:N4}\t{2:d}\t{3:N4}\t{4:C4}\t{5:N4}\t{6:N4}\t{7}", p.EntryDate, p.EntryPrice, p.ExitDate, p.ExitPrice, p.Profit, p.EntryCommission, p.ExitCommission, p.FuturesMode, p.Symbol, p.Quantity)); } }

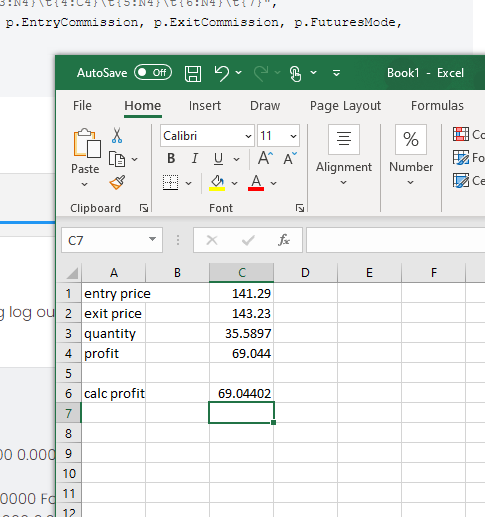

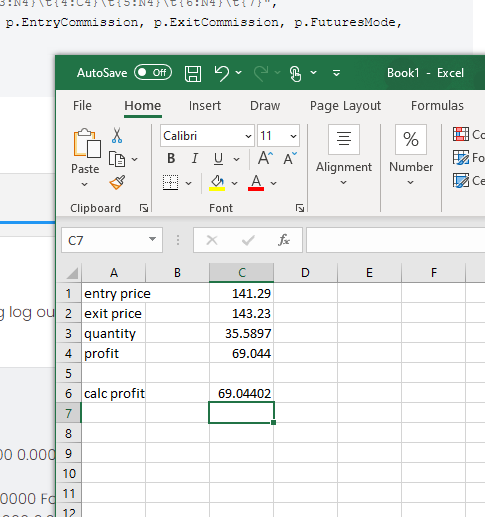

I am using IQFeed as my data source. The complete strategy code and the debug log output are shown below. Slippage is turned off and $0 commissions is used.

CODE:

--SPY-- SPY 35.5897 8/31/2012 141.2900 10/15/2012 143.2300 $69.0440 0.0000 0.0000 False SPY 34.857699999999994 12/12/2012 144.0000 8/16/2013 166.0600 $768.9609 0.0000 0.0000 False SPY 29.3582 9/17/2013 170.4600 1/27/2014 179.0600 $252.4805 0.0000 0.0000 False SPY 26.839800000000004 3/3/2014 184.6900 8/1/2014 192.5600 $211.2292 0.0000 0.0000 False SPY 25.062599999999996 8/22/2014 199.3400 10/13/2014 190.4600 ($222.5559) 0.0000 0.0000 False SPY 24.612299999999998 11/7/2014 203.1700 12/11/2014 203.8800 $17.4747 0.0000 0.0000 False SPY 23.669800000000002 2/23/2015 210.9400 3/9/2015 207.7400 ($75.7434) 0.0000 0.0000 False SPY 23.6787 4/24/2015 211.6600 6/9/2015 208.4500 ($76.0086) 0.0000 0.0000 False SPY 24.5978 10/19/2015 202.5000 12/14/2015 202.0700 ($10.5771) 0.0000 0.0000 False SPY 25.2385 3/2/2016 197.7400 5/5/2016 205.5600 $197.3651 0.0000 0.0000 False SPY 23.7823 5/31/2016 210.5600 6/27/2016 201.5900 ($213.3272) 0.0000 0.0000 False SPY 23.5128 7/11/2016 213.1900 8/3/2016 215.4800 $53.8443 0.0000 0.0000 False SPY 22.9168 8/8/2016 218.4000 9/12/2016 212.3900 ($137.7300) 0.0000 0.0000 False SPY 22.832 11/18/2016 219.0700 5/18/2017 235.7300 $380.3811 0.0000 0.0000 False SPY 20.681599999999996 5/26/2017 241.5400 6/28/2017 242.5000 $19.8543 0.0000 0.0000 False SPY 20.3616 7/17/2017 245.4700 8/11/2017 244.0200 ($29.5243) 0.0000 0.0000 False SPY 20.0634 9/12/2017 249.6300 6/26/2018 271.6400 $441.5954 0.0000 0.0000 False SPY 17.8833 7/16/2018 279.6400 10/11/2018 277.0800 ($45.7812) 0.0000 0.0000 False SPY 18.686 1/31/2019 267.5100 5/8/2019 287.5300 $374.0937 0.0000 0.0000 False SPY 17.0998 6/19/2019 292.5500 8/2/2019 293.8500 $22.2297 0.0000 0.0000 False SPY 16.5953 9/13/2019 301.7800 10/2/2019 291.5000 ($170.5997) 0.0000 0.0000 False SPY 16.485300000000002 10/29/2019 303.0000 2/26/2020 314.1800 $184.3057 0.0000 0.0000 False SPY 16.949099999999998 5/19/2020 294.3500 9/9/2020 337.5500 $732.2011 0.0000 0.0000 False SPY 14.1872 10/13/2020 352.2800 10/29/2020 326.9100 ($359.9293) 0.0000 0.0000 False SPY 14.1019 11/10/2020 353.4900 5/13/2021 407.0700 $755.5798 0.0000 0.0000 False SPY 11.803299999999998 6/11/2021 424.2000 6/21/2021 416.8000 ($87.3444) 0.0000 0.0000 False SPY 11.7203 6/28/2021 427.1700 9/21/2021 436.5300 $109.7020 0.0000 0.0000 False SPY 10.975700000000002 10/26/2021 457.2000 12/31/9999 0.0000 $110.3058 0.0000 0.0000 False

CODE:

using WealthLab.Backtest; using System; using WealthLab.Core; using WealthLab.Indicators; using System.Drawing; using System.Collections.Generic; namespace WealthScript2 { public class DynamicBreakout : UserStrategyBase { public override void Initialize(BarHistory bars) { TimeSeries shiftedMA = (bars.Close >> 1); TimeSeries Gain = (bars.Close - shiftedMA).Abs(); TimeSeries PctGain = (Gain / shiftedMA ); TimeSeries Short = SMA.Series(PctGain, 14); TimeSeries Long = SMA.Series(PctGain, 200); Vol = (( Short / Long) * 30); PlotTimeSeries(Vol, "Lookback Period", "Vol", Color.Olive, PlotStyles.ThickLine); HH = new TimeSeries(bars.DateTimes, 0); LL = new TimeSeries(bars.DateTimes, 0); PlotTimeSeries(HH, HH.Description, "Price", Color.Red, PlotStyles.Line); PlotTimeSeries(LL, LL.Description, "Price", Color.Green, PlotStyles.Line); StartIndex = 200; } public override void Execute(BarHistory bars, int idx) { int bar = idx; int Period = (int)Vol[bar]; HH[bar] = Highest.Value(bar, bars.High, Period); LL[bar] = Lowest.Value(bar, bars.Low, Period); if (!HasOpenPosition(bars, PositionType.Long)) { if (bars.Close[bar] > HH[bar - 1]) { PlaceTrade(bars, TransactionType.Buy, OrderType.Market); } } else { if (bars.Close[bar] < LL[bar - 1]) { PlaceTrade(bars, TransactionType.Sell, OrderType.Market); } } } public override void BacktestComplete() { foreach(Position p in Backtester.Positions) { WriteToDebugLog(string.Format("{8}\t{9}\t{0:d}\t{1:N4}\t{2:d}\t{3:N4}\t{4:C4}\t{5:N4}\t{6:N4}\t{7}", p.EntryDate, p.EntryPrice, p.ExitDate, p.ExitPrice, p.Profit, p.EntryCommission, p.ExitCommission, p.FuturesMode, p.Symbol, p.Quantity)); } } TimeSeries Vol, HH, LL; } }

Cone, all the numbers (entry, exit prices, and the number of shares) used in the calculations are being read off from the chart.

Let's scrutinize just the first logged item.

See, the profit is calculated correctly. Maybe you defined the Market/Symbol to use fractional shares?

See, the profit is calculated correctly. Maybe you defined the Market/Symbol to use fractional shares?

Glitch is right to pointed out about the fractional shares.

I think the errors might be due to the rounding-off all decimals in the number of shares that I see on the chart. For the first trade on the log file, the number of shares displayed on the chart is 36 shares, while the actual number of shares used by WL7 to calculate PNL is 35.5897 shares. Is there a switch that I can use to adjust the number of decimal precisions on # of shares and prices on the charts?

I think the errors might be due to the rounding-off all decimals in the number of shares that I see on the chart. For the first trade on the log file, the number of shares displayed on the chart is 36 shares, while the actual number of shares used by WL7 to calculate PNL is 35.5897 shares. Is there a switch that I can use to adjust the number of decimal precisions on # of shares and prices on the charts?

Currently not but since this has been a point of confusion we should address this!

The fractional shares are occurring because you've either defined the symbol's market or the symbol itself with a non-zero "Quantity Decimals" in Tools > Markets & Symbols. If you make that 0, then the shares will be integers - like on our runs.

Thanks.

Offtopic discussion moved to:

https://www.wealth-lab.com/Discussion/Unexpected-Position-Profit-value-when-accessing-it-inside-Execute-7142

https://www.wealth-lab.com/Discussion/Unexpected-Position-Profit-value-when-accessing-it-inside-Execute-7142

Your Response

Post

Edit Post

Login is required