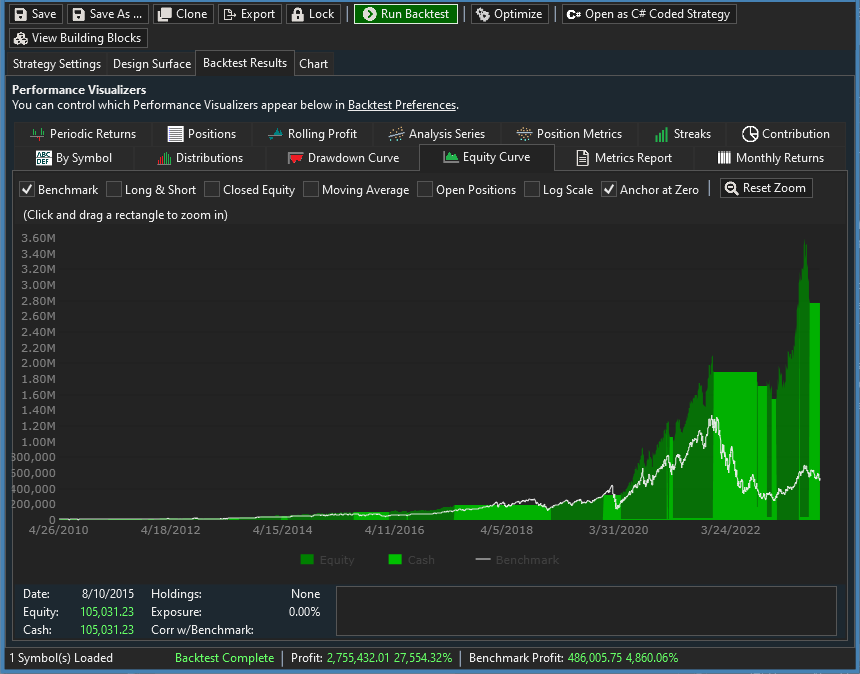

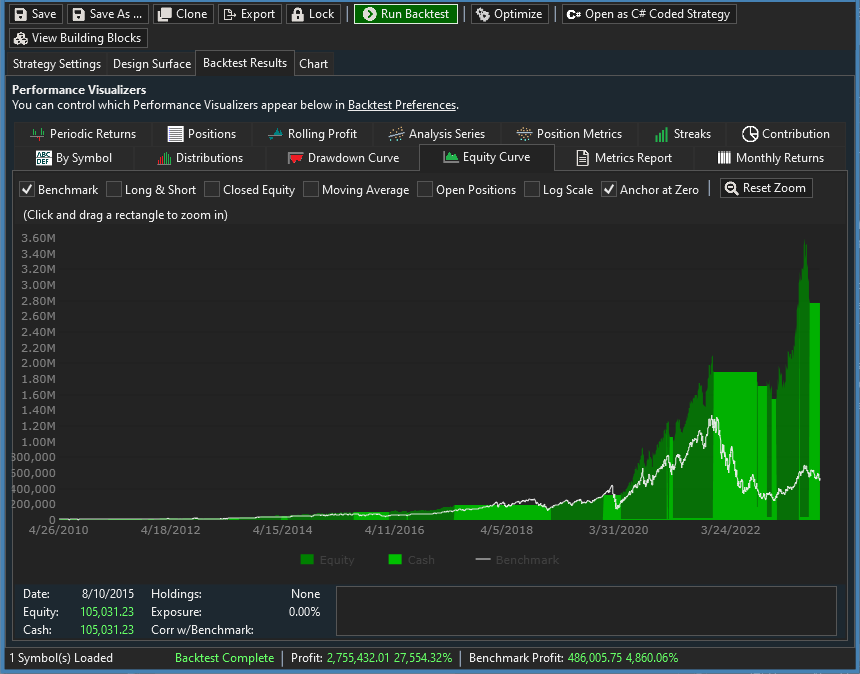

When I check "Retain NSF Positions", my strategy produces a much stronger equity curve than when it is not checked. Of course I want the first one to be true, but it looks like the backtest does not enter certain positions when losing signals should be produced. I also get the same phenomenon when I choose "Market Open Next Bar" instead of "Market Close this Bar".

So, in essence, is the first equity curve just a bunch of lucky trades or is there something to it?

First Equity Curve (Retain NSF checked)

Second Equity Curve (Retain NSF unchecked)

Thanks!

So, in essence, is the first equity curve just a bunch of lucky trades or is there something to it?

First Equity Curve (Retain NSF checked)

Second Equity Curve (Retain NSF unchecked)

Thanks!

Rename

It looks like there’s not enough positions in either backtest to draw any statistically significant conclusions.

Thank you Glitch. I know this is a loaded question but as a rule of thumb what are the minimum number of positions you deem statistically Significant?

Personally I like to see a few hundred, I typically backtest on large DataSets.

QUOTE:But do you understand why?

the backtest does not enter certain positions when losing signals should be produced.

If you do, great.

If not, here's a video that explains the difference: https://youtu.be/HXA-AetQ3Jk

Your Response

Post

Edit Post

Login is required