Which trading venue do you choose for your market on open orders? I have noticed that IB's smart routing can lead to deviations in the opening prices (the official open price does not match the execution). According to IB, the official quotes (the published open price) would come from the NYSE. Do you use smart routing or do you select the NYSE as your stock exchange?

The answer from IB was:

"The official opening price derived from the opening auction, where the OPG orders are sent, are those are always printed on NYSE. You can check this in your TWS platform "Time and Sales" for the instruments direct routed to NYSE (or looking at the chart for the instruments direct routed to NYSE).

To direct rout an order to a specific exchange in TWS you can type the symbol in an empty line and select "Stock (Direct)" and select NYSE."

The answer from IB was:

"The official opening price derived from the opening auction, where the OPG orders are sent, are those are always printed on NYSE. You can check this in your TWS platform "Time and Sales" for the instruments direct routed to NYSE (or looking at the chart for the instruments direct routed to NYSE).

To direct rout an order to a specific exchange in TWS you can type the symbol in an empty line and select "Stock (Direct)" and select NYSE."

Rename

Re: MOO... (the official open price does not match the execution)

I'm afraid you're mistaken. What source are you using for the "official open price"?

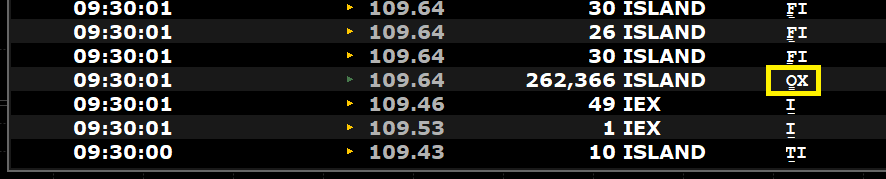

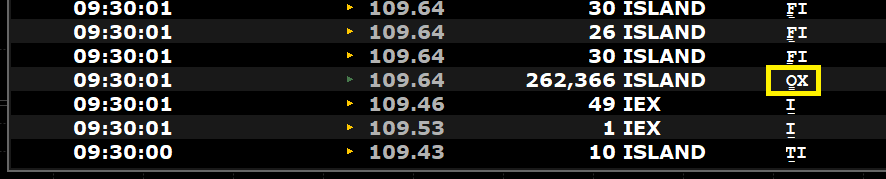

IB's answer is correct, though Nasdaq also has an official open, and here's what that looks like for either NYSE or Nasdaq:

See: Wrong value for the most-used order type?

https://www.wealth-data.com/faq

I'm afraid you're mistaken. What source are you using for the "official open price"?

IB's answer is correct, though Nasdaq also has an official open, and here's what that looks like for either NYSE or Nasdaq:

See: Wrong value for the most-used order type?

https://www.wealth-data.com/faq

For the official opening price I took the price of WealthData, IB and also Norgatedata. Now I have again compared individual trades with all three data feeds... Well, what can I say, there are deviations. So my finding is directly related to the different data feeds. I was not previously aware that such deviations occur in individual trades. Especially as I had not noticed any deviations in the past. However, this seems to happen occasionally. @Cone Thank you for your brief explanation.

As we say on Wealth-Data.com, only the WealthData provider will give you the primary market opening price (for the large caps we cover).

There is no other provider that I know of that does that.

There is no other provider that I know of that does that.

Your Response

Post

Edit Post

Login is required