Hi

I am not sure what I am doing wrong with this simple VIX filter. If I run it just on SPY, with the VIX requirement off, trades occur. When I switch on the requirement for VIX to be below 40 (and exit when VIX is above 40), there are no trades at all in the backtest. I have bulk updated all the CBOE data. Any ideas, please? Image below.

Thank you and best regards, Rod

Thank you and best regards, Rod

I am not sure what I am doing wrong with this simple VIX filter. If I run it just on SPY, with the VIX requirement off, trades occur. When I switch on the requirement for VIX to be below 40 (and exit when VIX is above 40), there are no trades at all in the backtest. I have bulk updated all the CBOE data. Any ideas, please? Image below.

Thank you and best regards, Rod

Thank you and best regards, Rod

Rename

PS: The Strategy Settings are here:

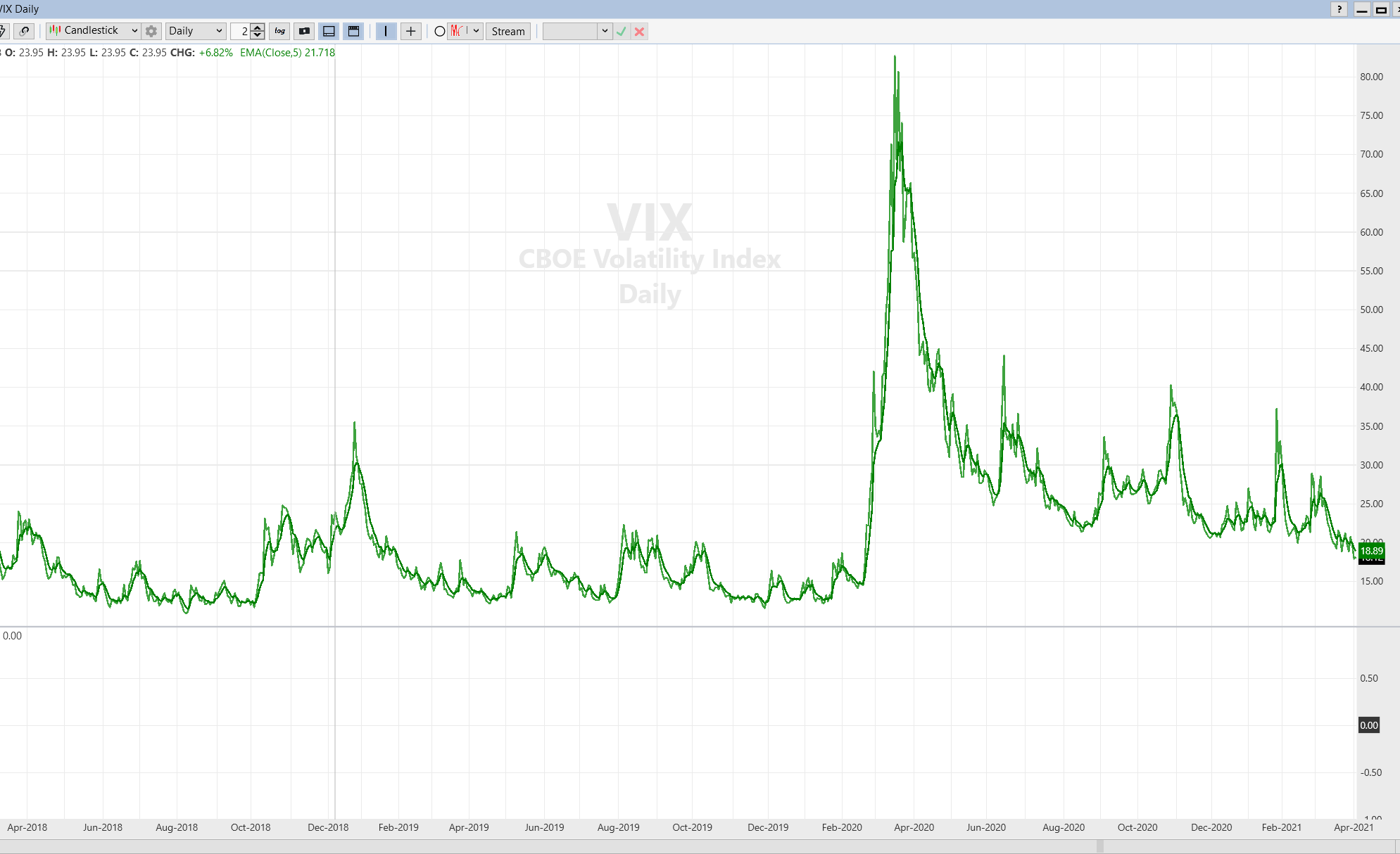

Start a chart, enter VIX, drop an EMA(5) on it, and you'll see why.

If you're actually getting data for VIX, probably you'll have better luck getting trades with values in the 20-ish range.

If you're actually getting data for VIX, probably you'll have better luck getting trades with values in the 20-ish range.

Hi. I'm missing your point here, sorry. I have used this filter for ages (on Wealth Lab 6). It enters when VIX is LESS than 40 - so is basically in all the time - except for the GFC and the Covid crash. I had the Covid period in my time range. Did I misunderstand your answer?

Best regards

Rod

Best regards

Rod

Perhaps the percent of equity is set too high (100). You can also change the Basis price.

Hi Eugene

Neither of those solved it...

BUT...

I solved it. I just tried putting a $ sign in front of VIX in the Design Surface (so it reads "Using Symbol $VIX"), and it worked. Why would that be required?

Thanks:)

Regards

Rod

Neither of those solved it...

BUT...

I solved it. I just tried putting a $ sign in front of VIX in the Design Surface (so it reads "Using Symbol $VIX"), and it worked. Why would that be required?

Thanks:)

Regards

Rod

That means you probably don't have CBOE (which has VIX as a symbol) checked in the Historical Data Providers. $VIX is coming from Wealth-Data (probably), which you probably have checked.

... I thought you'd figure that out with the chart test, but there you probably clicked on VIX in your CBOE DataSet.

But the problem I see with the strategy is that you're going to buy SPY (almost always) immediately because VIX EMA(5) is almost always below 40. You should use Indicator "Crosses Value" instead of "Compare to Value" blocks to trigger the condition instead of using conditions as a filter.

... I thought you'd figure that out with the chart test, but there you probably clicked on VIX in your CBOE DataSet.

But the problem I see with the strategy is that you're going to buy SPY (almost always) immediately because VIX EMA(5) is almost always below 40. You should use Indicator "Crosses Value" instead of "Compare to Value" blocks to trigger the condition instead of using conditions as a filter.

Thanks Cone regarding the data. Yes with the chart I clicked on VIX in my CBOE DataSet.

Regarding the strategy, that is the point - it is basically long SPY all the time except for when VIX spikes. I don't use it usually on SPY, but I use it on many of my equity screen strategies to be long almost all the time apart from VIX spikes and long downtrends. It cuts drawdown with little to no impact on returns.

Regarding the strategy, that is the point - it is basically long SPY all the time except for when VIX spikes. I don't use it usually on SPY, but I use it on many of my equity screen strategies to be long almost all the time apart from VIX spikes and long downtrends. It cuts drawdown with little to no impact on returns.

Your Response

Post

Edit Post

Login is required