Hi WL Team,

I am trying to trade a strategy which runs on daily bars and figure out that it is not necesary to use the Strategy Monitor, as the help page mentioned that "Generally, the Strategy Monitor is used to run strategies on all symbols of a DataSet (or a symbol of choice) for live intraday trading."

Out of curiosity, I decided to test out the Strategy Monitor but realize that for the same strategy, the Orders generated from Strategy Monitor are different from the Signals generated from Strategy Window.

Why would they be different and should I be placing the Orders from Strategy Monitor or the Signals from Strategy Window into the Order Manager for execution with my broker, Interactive Brokers?

pmbf

I am trying to trade a strategy which runs on daily bars and figure out that it is not necesary to use the Strategy Monitor, as the help page mentioned that "Generally, the Strategy Monitor is used to run strategies on all symbols of a DataSet (or a symbol of choice) for live intraday trading."

Out of curiosity, I decided to test out the Strategy Monitor but realize that for the same strategy, the Orders generated from Strategy Monitor are different from the Signals generated from Strategy Window.

Why would they be different and should I be placing the Orders from Strategy Monitor or the Signals from Strategy Window into the Order Manager for execution with my broker, Interactive Brokers?

pmbf

Rename

Hi Eugene,

I looked through the post you sent in your reply and checked that the datasets, position sizings are the same.

However, differences remain. Please see the portfolio sync options, and the signals from strategy window and the orders from strategy monitor. Only the sell signals differ, if that offers any clue to the mystery.

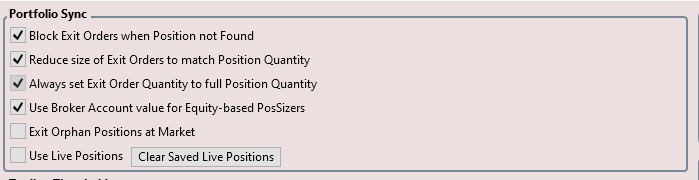

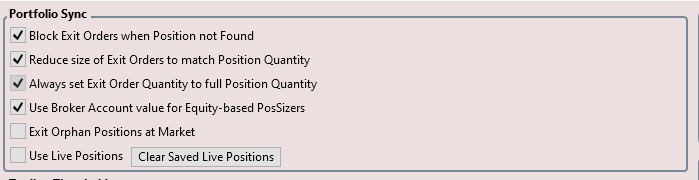

Portfolio Sync

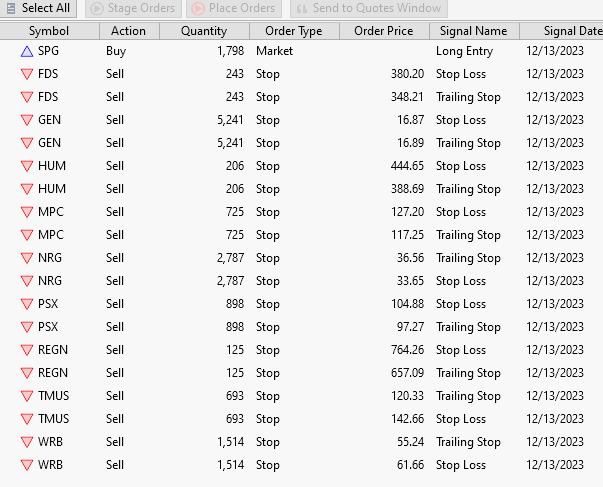

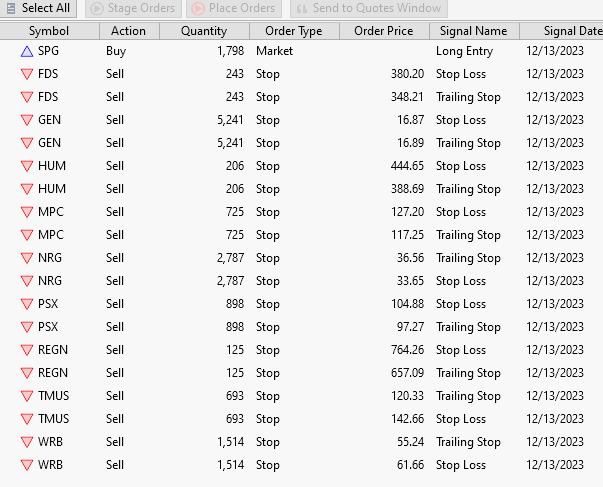

Strategy Monitor Order

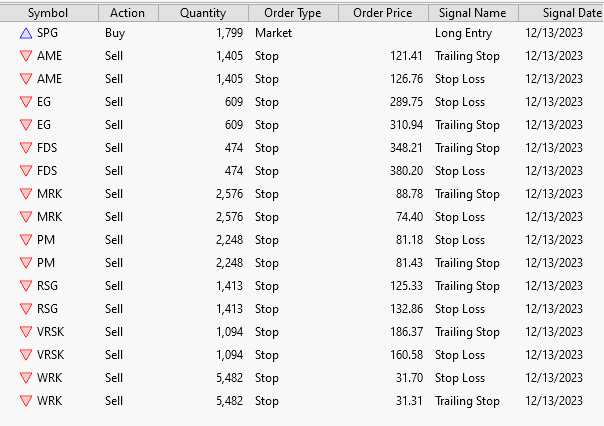

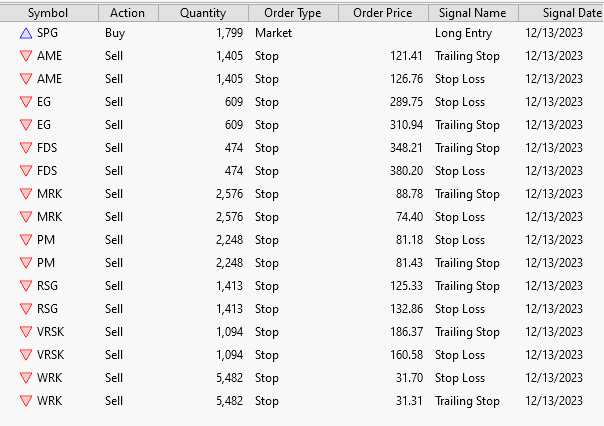

Strategy Window Signals

pmbf

I looked through the post you sent in your reply and checked that the datasets, position sizings are the same.

However, differences remain. Please see the portfolio sync options, and the signals from strategy window and the orders from strategy monitor. Only the sell signals differ, if that offers any clue to the mystery.

Portfolio Sync

Strategy Monitor Order

Strategy Window Signals

pmbf

Hi Brandon,

What about 1) "Retains NSF Positions" and/or Transaction Weight (since the entry uses a market order)?

What about 1) "Retains NSF Positions" and/or Transaction Weight (since the entry uses a market order)?

Hi Eugene,

I have unchecked "Retain NSF Positions" since all my transactions have weights. In any case, I manage to reconcile the orders and signals from both strategy monitor and strategy window after synchronizing the data range in both strategy monitor and strategy window.

However, the quantity of shares for each order in strategy monitor and for each signal in strategy window differs by about 30% consistently. I figure out that the difference is attributed to the capital which Strategy Monitor uses and tries to reverse-calculate it via offsetting the 30% difference from my starting capital in Strategy Window. However, that calculated number does not reconcile with my broker capital. What is the amount of capital used in Strategy Monitor?

pmbf

I have unchecked "Retain NSF Positions" since all my transactions have weights. In any case, I manage to reconcile the orders and signals from both strategy monitor and strategy window after synchronizing the data range in both strategy monitor and strategy window.

However, the quantity of shares for each order in strategy monitor and for each signal in strategy window differs by about 30% consistently. I figure out that the difference is attributed to the capital which Strategy Monitor uses and tries to reverse-calculate it via offsetting the 30% difference from my starting capital in Strategy Window. However, that calculated number does not reconcile with my broker capital. What is the amount of capital used in Strategy Monitor?

pmbf

Sounds like a difference in Margin Factor?

Another explanation is that the S. Monitor does not guarantee that the whole DataSet will be run in a single batch. I'm not sure if this applies to Daily+, but the S. Monitor may run in several batches, and each batch gets its own equity curve. How large is your DataSet?

Show us the Log of a typical run and we can determine if that's a possibility.

Show us the Log of a typical run and we can determine if that's a possibility.

Hi Cone and Eugene,

thanks for your reply.

I was running the strategy on the stocks in S&P 500 Index based on 300 bars of data Anyway, the reason for the 30% difference was because I was trying to buy USD stocks but my interactive brokers account was denominated in SGD, which has a USDSGD FX rate of about 1.33.

The numbers match up after I adjust my USD starting capital in strategy window to the SGD acount value in my interactive brokers account.

pmbf

thanks for your reply.

I was running the strategy on the stocks in S&P 500 Index based on 300 bars of data Anyway, the reason for the 30% difference was because I was trying to buy USD stocks but my interactive brokers account was denominated in SGD, which has a USDSGD FX rate of about 1.33.

The numbers match up after I adjust my USD starting capital in strategy window to the SGD acount value in my interactive brokers account.

pmbf

Take a look at Preferences > Backtest > Multi-Currency.

Hit F1 and read about it in the guide, but if you enable this setting for SGD, sizing will be corrected for USD automatically. For the backtest, however, make sure to convert your Starting Capital to SGD.

For example, if you started your 100000 USD backtest in Jan 2010 when USDSGD was 1.40, make the starting capital 140000. Then, when trading U.S.-denominated stocks, you'll get all the results in your SGD base and the exchange effect will be accounted for.

Hit F1 and read about it in the guide, but if you enable this setting for SGD, sizing will be corrected for USD automatically. For the backtest, however, make sure to convert your Starting Capital to SGD.

For example, if you started your 100000 USD backtest in Jan 2010 when USDSGD was 1.40, make the starting capital 140000. Then, when trading U.S.-denominated stocks, you'll get all the results in your SGD base and the exchange effect will be accounted for.

Your Response

Post

Edit Post

Login is required