After last weeks discussion on Position Sizer selection, I decided to switch my paper trading to running individual strategies standalone with "Max Risk % Limited to % of Equity". I started the week with 30 securities across 4 strategies and ended the week with zero. Ever curious, Wednesday evening I started looking for answers. Here is what I found:

If I set the Position Size to "Max Risk Percent", the following signals are raised:

If I set the Position Size to "Advanced Pos Sizer"->"Max Risk % Limited to % of Equity", the following signals are raised:

There are 119 short orders missing from the latter. Same scenario holds for other 3 strategies. WL knows about them, because in tomorrows backtest run, they will show up as newly opened positions. Similarly, when I run the strategies inside a metastrategy and set the Position Size to "Max Risk Percemt" the signals I receive are:

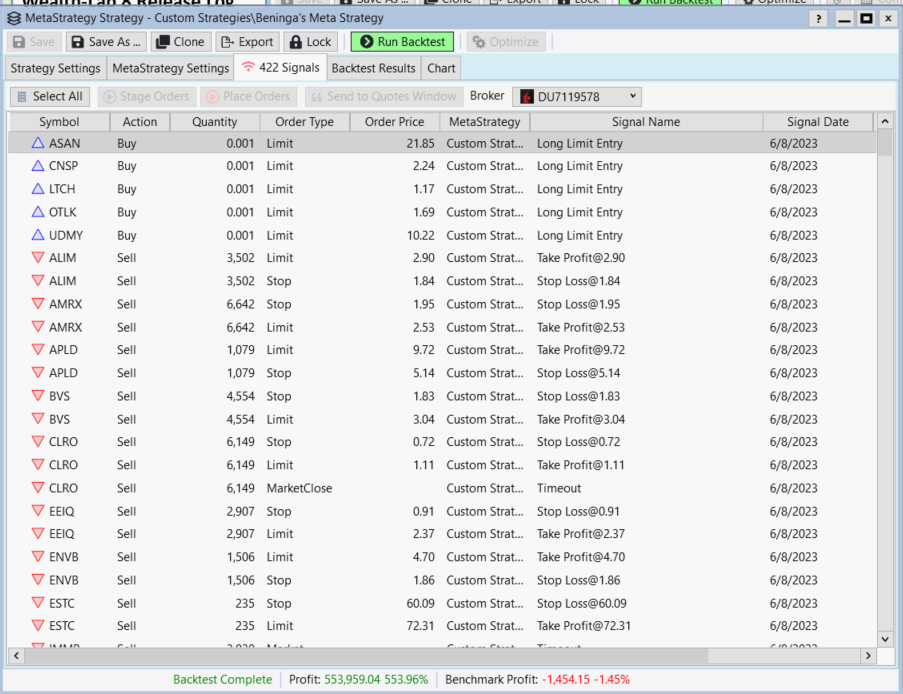

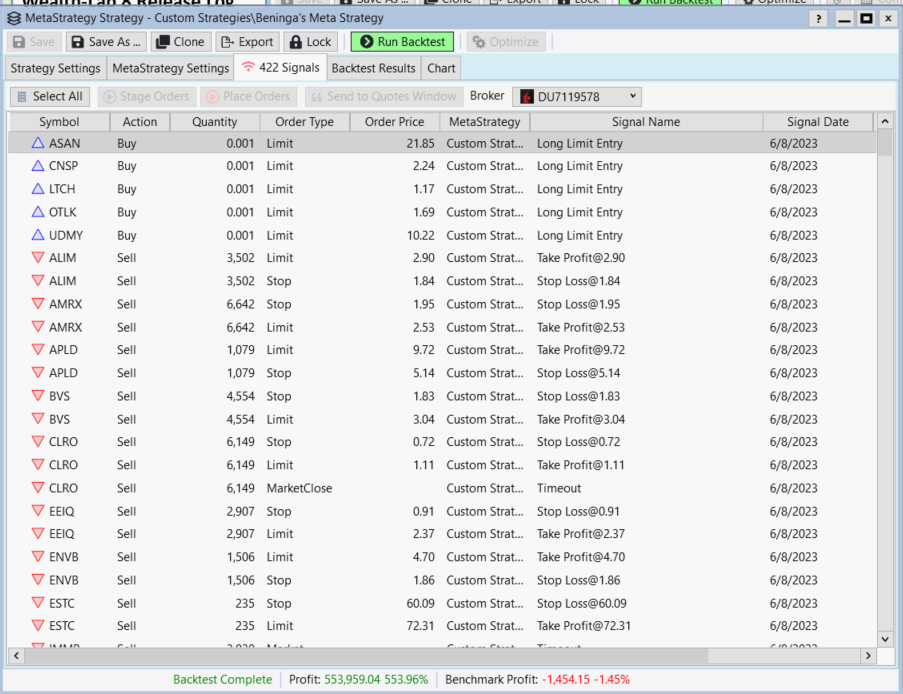

and with "Advanced Pos Sizer"->"Max Risk % Limited to % Equity" I get these signals:

and

Look at the quantity column for the position openings, 0.001. At least this time WL informed me of the potential. I could go in and adjust the position size to the correct value, but that kind of defeats the purpose of saving time in the morning.

Not trying to be hard on y'all, Love the software!

-sifty

If I set the Position Size to "Max Risk Percent", the following signals are raised:

If I set the Position Size to "Advanced Pos Sizer"->"Max Risk % Limited to % of Equity", the following signals are raised:

There are 119 short orders missing from the latter. Same scenario holds for other 3 strategies. WL knows about them, because in tomorrows backtest run, they will show up as newly opened positions. Similarly, when I run the strategies inside a metastrategy and set the Position Size to "Max Risk Percemt" the signals I receive are:

and with "Advanced Pos Sizer"->"Max Risk % Limited to % Equity" I get these signals:

and

Look at the quantity column for the position openings, 0.001. At least this time WL informed me of the potential. I could go in and adjust the position size to the correct value, but that kind of defeats the purpose of saving time in the morning.

Not trying to be hard on y'all, Love the software!

-sifty

Rename

I'll be back in office next week. Will look into the issue then.

Thank you DrKoch! I'm back to Max Risk % = 1.5 for the time being.

Oh, and thank you for the introduction to the Bensdorp book.

Your Response

Post

Edit Post

Login is required